Effect of Demonetisation - Should I buy Flat/Apartment now ???

This article is written on 9th Jan 2017 (post demonetisation results and banks reducing interest rates)

Introduction: After declaration of demonetisation by Narendra Modi on Nov-8, it is estimated and declared that real estate will see huge fall down. Media made predictions that prices will crumble down like never before, to an extent of 30%-50%.

Did it really happen? Will it happen in future?

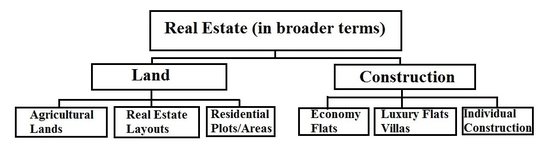

What is Real Estate - Real estate (in broader terms) can be divided into 2 categories - land dealings and construction. In analyzing the effect on real estate, one mistake done is - predictions are generalized for all categories in common.

However, each category has different level of impacts of Demonetisation. The below views in this article are applicable to Apartment Economy Flats Exclusively (not entire real estate).

Post-Demonetisation - When demonetisation is declared, Government estimated that around Rs.2.5Lakh-3Lakh crores of black money will not come into banking system. This would have reduced liquidity in the market by around 20%. In addition, Government wanted to put limits on cash usage forever.

However, at the end of this process, Government realized that public is much smarter than them :). It's very tough to change citizen's mindset, related to cash transactions. It couldn't achieve its results.

- No black money is found. All money is deposited into banking system and is being withdrawn by public now.

- Moving citizens towards cash-less system is very tough and they want to have cash physically.

RBI has printed and released Rs.9.2Lakh crores into the system, as on 15-Jan-17.

Effect on Real Estate (purchasing of Apartment Flats) - With huge media propaganda that real estate fell down by 30%-50%, prospective customers are in search of flats/properties with reduced rates. They expected prices fall down by 30% (whether it's economy or deluxe or luxury flats). In reality, they couldn't find such properties. Its a STANDSTILL state now.

For sure, real estate is down. But it is in terms of NUMBER OF TRANSACTIONS, not property prices. No transactions are happening at the moment. You can not find flats at such lower rates.

Reasons for no fall down in ECONOMY apartment price rates -

i. Due to more ventures and high competition, builders are already selling apartments with less margin.

ii. Due to high land prices and increasing construction cost, it's MRP(Minimum Retail Price) price for builders.

iii. Most of the flats are sold with loan assistance from Banks. Entire transaction is WHITE AMOUNT. It's just that our cash handling habit, is forcing us to do cash transaction. Otherwise, entire flat sale transaction can be done in CHEQUE. When entire transaction can be done in CHEQUE, how can demonetisation reduce the prices?

iv. Cash flow has already eased and withdrawal limits are slowly removed. There is no difference in the system before 8-Nov-2016 and after 7-Jan-2017. Then, why prices will fall down?

When banks reduced interest rates by 0.5%-0.7%, it gave an opportunity for customers to purchase flats with more bank finance. Clever customers are taking this opportunity and purchasing right properties at low interest rates.

What can happen next - For sure, prices are not going to increase immediately and no boom is going to happen. However, there are two possibilities can happen in 2-4 months time.

i. increase in loan interest rates - When public deposited their money in Nov and Dec-2016 months, banks have reduced interest rates in January-2017 due to availability of more funds. As public is withdrawing cash from banks now, banks will slowly increase interest rates. There could be increase of 0.2%-0.4% in next 2-4 months, depending on cash withdrawal by public.

Whatever interest rates are offered now, are best rates. Banks can't reduce more than this.

ii. increase in land prices by Govt - BIGGEST THREAT - As very less number of registrations are happening, income from this department fell down drastically for the Government. To overcome this, only option before Government is - to increase land registration prices abnormally. When Government increases land prices, it will increase flat registration charges, VAT tax, service tax for the customers. Customers have to shell out more for taxes.

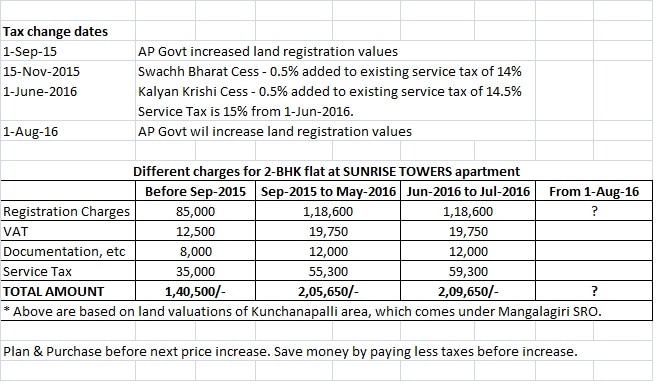

For example, when we started our SUNRISE TOWERS venture in June-2015, all registration related expenses is around Rs.1,40,000/- for a 2BHK flat for customer. Government had increased land prices twice since then, October-2015 and Aug-2016. Now registration related expenses will cost around Rs.2,10,000/- for a 2BHK flat. It's an increase by Rs.70,000/-, which should be borne by customer and goes to Government. This time, land price increase can happen around Apr-2017 and price increase is going to be huge. Government has to cover the income fall deficit.

Conclusion - Be Clear that - there is no fall of 30% or something like that. Things are going back to normal now. Customers should try to grab good properties/flats at marginal rates. Customers have to take advantage of low home loan interest rates now.

To avoid land prices increase by Govt, COMPLETE YOUR FLAT PURCHASE BEFORE 1-APR-2017.

If flat is ready to occupy, you can claim home loan repayment & interest under income tax deductions immediately.

If flat is ready to occupy, you can claim registration & stamp duty amount under section-80C of income tax deductions.

Introduction: After declaration of demonetisation by Narendra Modi on Nov-8, it is estimated and declared that real estate will see huge fall down. Media made predictions that prices will crumble down like never before, to an extent of 30%-50%.

Did it really happen? Will it happen in future?

What is Real Estate - Real estate (in broader terms) can be divided into 2 categories - land dealings and construction. In analyzing the effect on real estate, one mistake done is - predictions are generalized for all categories in common.

However, each category has different level of impacts of Demonetisation. The below views in this article are applicable to Apartment Economy Flats Exclusively (not entire real estate).

Post-Demonetisation - When demonetisation is declared, Government estimated that around Rs.2.5Lakh-3Lakh crores of black money will not come into banking system. This would have reduced liquidity in the market by around 20%. In addition, Government wanted to put limits on cash usage forever.

However, at the end of this process, Government realized that public is much smarter than them :). It's very tough to change citizen's mindset, related to cash transactions. It couldn't achieve its results.

- No black money is found. All money is deposited into banking system and is being withdrawn by public now.

- Moving citizens towards cash-less system is very tough and they want to have cash physically.

RBI has printed and released Rs.9.2Lakh crores into the system, as on 15-Jan-17.

Effect on Real Estate (purchasing of Apartment Flats) - With huge media propaganda that real estate fell down by 30%-50%, prospective customers are in search of flats/properties with reduced rates. They expected prices fall down by 30% (whether it's economy or deluxe or luxury flats). In reality, they couldn't find such properties. Its a STANDSTILL state now.

For sure, real estate is down. But it is in terms of NUMBER OF TRANSACTIONS, not property prices. No transactions are happening at the moment. You can not find flats at such lower rates.

Reasons for no fall down in ECONOMY apartment price rates -

i. Due to more ventures and high competition, builders are already selling apartments with less margin.

ii. Due to high land prices and increasing construction cost, it's MRP(Minimum Retail Price) price for builders.

iii. Most of the flats are sold with loan assistance from Banks. Entire transaction is WHITE AMOUNT. It's just that our cash handling habit, is forcing us to do cash transaction. Otherwise, entire flat sale transaction can be done in CHEQUE. When entire transaction can be done in CHEQUE, how can demonetisation reduce the prices?

iv. Cash flow has already eased and withdrawal limits are slowly removed. There is no difference in the system before 8-Nov-2016 and after 7-Jan-2017. Then, why prices will fall down?

When banks reduced interest rates by 0.5%-0.7%, it gave an opportunity for customers to purchase flats with more bank finance. Clever customers are taking this opportunity and purchasing right properties at low interest rates.

What can happen next - For sure, prices are not going to increase immediately and no boom is going to happen. However, there are two possibilities can happen in 2-4 months time.

i. increase in loan interest rates - When public deposited their money in Nov and Dec-2016 months, banks have reduced interest rates in January-2017 due to availability of more funds. As public is withdrawing cash from banks now, banks will slowly increase interest rates. There could be increase of 0.2%-0.4% in next 2-4 months, depending on cash withdrawal by public.

Whatever interest rates are offered now, are best rates. Banks can't reduce more than this.

ii. increase in land prices by Govt - BIGGEST THREAT - As very less number of registrations are happening, income from this department fell down drastically for the Government. To overcome this, only option before Government is - to increase land registration prices abnormally. When Government increases land prices, it will increase flat registration charges, VAT tax, service tax for the customers. Customers have to shell out more for taxes.

For example, when we started our SUNRISE TOWERS venture in June-2015, all registration related expenses is around Rs.1,40,000/- for a 2BHK flat for customer. Government had increased land prices twice since then, October-2015 and Aug-2016. Now registration related expenses will cost around Rs.2,10,000/- for a 2BHK flat. It's an increase by Rs.70,000/-, which should be borne by customer and goes to Government. This time, land price increase can happen around Apr-2017 and price increase is going to be huge. Government has to cover the income fall deficit.

Conclusion - Be Clear that - there is no fall of 30% or something like that. Things are going back to normal now. Customers should try to grab good properties/flats at marginal rates. Customers have to take advantage of low home loan interest rates now.

To avoid land prices increase by Govt, COMPLETE YOUR FLAT PURCHASE BEFORE 1-APR-2017.

If flat is ready to occupy, you can claim home loan repayment & interest under income tax deductions immediately.

If flat is ready to occupy, you can claim registration & stamp duty amount under section-80C of income tax deductions.